Pro-Cash Legislation in 2024: Safeguarding the Role of Cash in Modern Transactions

Cash, often considered the bedrock of financial transactions, has withstood the test of time as a simple yet essential form of payment. Meanwhile, as we enter the last months of 2023 and prepare for a new year, the backdrop of rising inflation rates looms large. Recent data reveals the persistent challenge posed by inflation, prompting policymakers to consider unconventional measures.

Inflation in The News

Federal Reserve Governor Michelle Bowman suggests that interest rates may need to rise further and remain high for an extended period to tame inflation. Inflation persists above the Federal Open Market Committee's (FOMC) 2% target, driven by robust domestic spending and a tight labor market, as reported by Bloomberg.

Meanwhile, cost of living continues to rise, causing a shift towards heightened cash use in younger demographics. While cash payments persist alongside the challenges of inflation and the rising cost of living, we turn our attention to the pivotal role of pro-cash legislation in 2023. These legislative measures aim to safeguard cash's significance in modern transactions, promote financial inclusion, and address the evolving needs of diverse consumer segments.

We'll explore how policymakers are ensuring that cash retains its irreplaceable role in the broader context.

Common Ground: Similarities in Pro-Cash Legislation

According to the 2023 Global Payments Report, cash still plays a vital role, accounting for over $7.6 trillion in global consumer spending in 2022. Notably, cash is not just relevant but often mandatory for point-of-sale (POS) merchants across numerous markets.

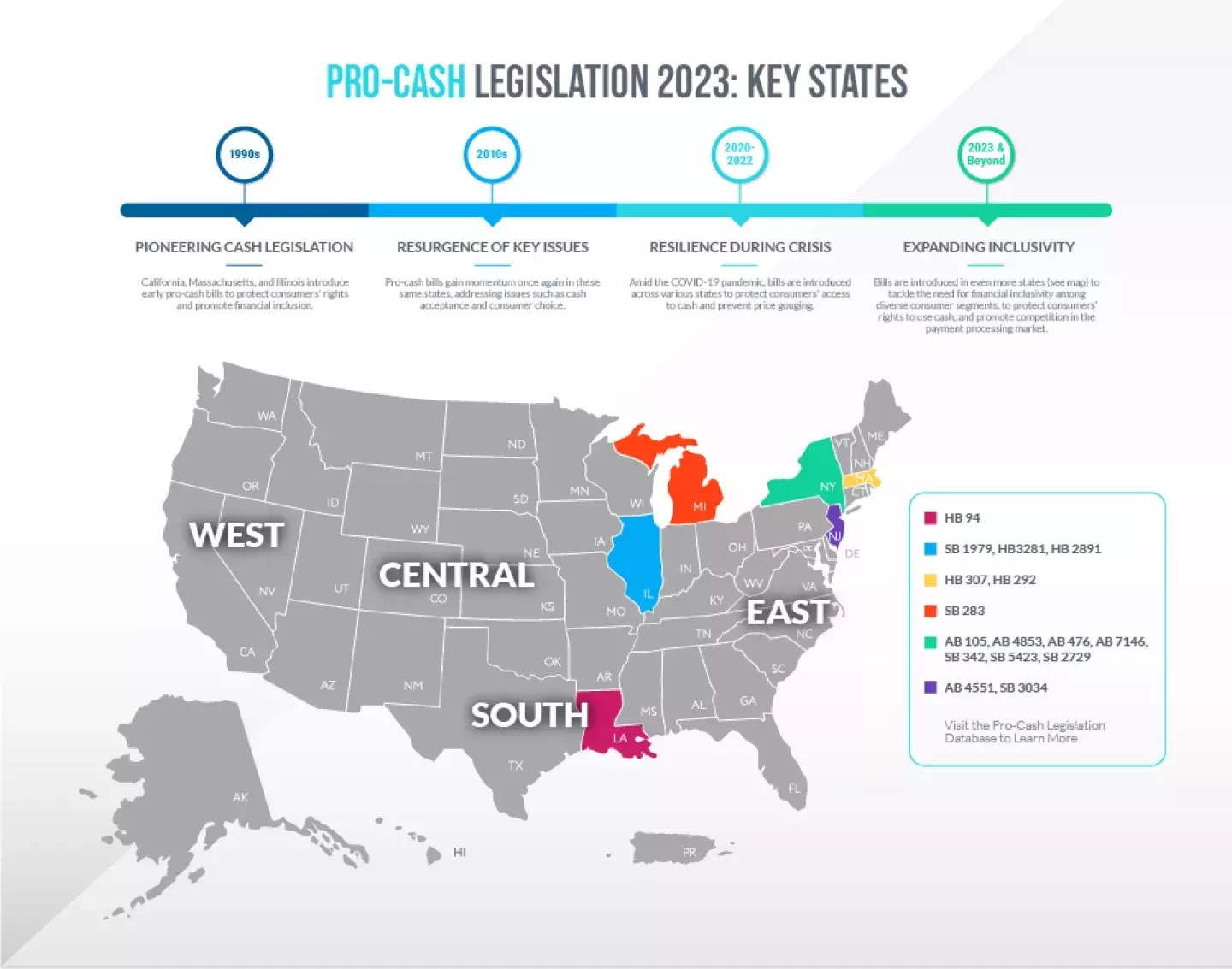

Pro-cash legislation isn't entirely new, with several states having already laid the foundation. These older bills serve as a backdrop to the renewed emphasis on cash in 2023 and beyond. They set the stage for the shared objectives that have become the cornerstone of current legislative efforts.

Cash Acceptance Mandate

Many of the 2023 bills, inspired by their predecessors, reinforce the need for businesses to accept cash as a valid form of payment. For instance, Louisiana's HB 94 (2023) explicitly makes it illegal to impair or tamper with ATMs with the intent to steal currency or personal financial information. This emphasizes the fundamental role of cash in facilitating transactions.

Protection Against Discrimination

Building on the foundations laid by earlier bills, these legislations aim to eliminate discrimination based on payment methods. Illinois' SB 1979 (2023) and HB 3281 (2023) require businesses to accept cash for transactions below $2,000. They prevent businesses from posting signs that cash isn't accepted or charging higher prices to cash-paying customers, reinforcing inclusivity.

Promotion of Consumer Choice

These bills champion the preservation of consumer choice. Massachusetts's HB 307 (2023) reaffirms that consumers have the right to use cash for transactions without being forced to convert it into electronic debit or credit cards, emphasizing freedom of choice.

Application to Retail and Service Establishments

The 2023 bills collectively assert that the right to use cash is universal, applicable to retail and service establishments. Michigan's SB 283 (2023) makes it illegal for retail businesses to refuse cash, making no distinction between sectors.

Exemptions for Specific Transactions

The bills remain adaptable to the evolving payment landscape, offering exemptions for specific transactions. For example, New York's AB 476 (2023) makes it illegal for food or retail establishments to refuse cash but allows for alternative payment options when deemed necessary.

The Variations: Differences in State-Specific Bills

While newer bills unite in their mission to reinforce the importance of cash, they exhibit variations worth noting.

Geographical Scope

Each bill has its unique geographical scope, applying exclusively within its respective state's jurisdiction. For example, California's 2019 legislation prevents businesses in San Francisco and West Hollywood from denying cash payments in brick-and-mortar businesses, ensuring that cash remains accepted in these specific areas.

Penalties

The penalties for non-compliance vary across bills. Some states opt for classifying offenses based on monetary value, such as Missouri's SB 186 (2023), which distinguishes between different degrees of felony depending on the damage to ATMs. Conversely, Tennessee's HB 1306 (2023) underscores compliance through a less punitive approach, ensuring that retail establishments accept cash without imposing specific penalties.

Specific Provisions

Certain bills introduce unique aspects tailored to address specific issues. Montana's SB 558 (2023) defines clear exceptions when businesses may not accept cash, focusing on providing flexibility while maintaining cash's significance. In contrast, Massachusetts's HB 292 (2023) emphasizes the importance of adequate lighting for ATMs, targeting security concerns in a distinctive way.

Purpose of Cash

While some bills primarily emphasize cash acceptance, others address broader security and identity theft issues. Illinois' SB 1979 (2023) focuses on preserving the use of cash as a means of payment, promoting inclusivity, and ensuring that consumers have the freedom to choose. In contrast, Illinois's HB 2891 (2023) is more security-oriented, introducing harsh penalties for forcible withdrawal from electronic fund transfer terminals.

These variations reveal the diverse approaches states take to achieve the shared goal of preserving cash's role in modern transactions. From geographic nuances to tailored provisions, each state's legislation aligns with its unique circumstances, contributing to the broader effort of safeguarding cash's relevance.

Closing Takeaways for The Future of Cash

The tangible nature of cash continues to resonate with consumers, as the value of cash isn't just symbolic; it's tangible, immediate, and universally accepted, transcending the complexities and potential costs associated with digital alternatives.

In 2022, it was estimated that 7 million American households were unbanked. This is significant because according to the US Treasury, lower-income consumers are “several times more likely to make payments in cash than consumers with higher income”.

The US Treasury also asserts that “certain segments of the population may disproportionately bear the costs and inefficiencies of payment systems,” calling for the US to “maximize user choice and take steps to preserve the ability of consumers to use cash.”

Pro-cash legislation in 2023 safeguards the use of cash and has far-reaching implications. As we look to 2024 and beyond, we can expect similar themes:

- Consumer Choice: These laws protect consumers' right to use cash, ensuring it remains a viable payment option.

- Financial Inclusion: They promote inclusivity, catering to the diverse needs of consumers.

- Price Fairness: Prohibiting unfair discrimination, they maintain price equity for cash users.

- Security: Recognizing cash's unique security, especially in an age of digital threats.

Recent legislative action continues to reinforce cash's importance and its enduring role in the payment landscape. Amid rising inflation, they preserve financial choice, inclusivity, and fairness, ensuring cash remains a resilient cornerstone in our evolving financial world.

Find out how we can help with your cash management.

Contact Us